All Categories

Featured

Table of Contents

If you pick degree term life insurance policy, you can allocate your premiums because they'll remain the same throughout your term (20-year level term life insurance). Plus, you'll understand exactly just how much of a survivor benefit your recipients will receive if you pass away, as this amount will not alter either. The prices for level term life insurance policy will depend on a number of aspects, like your age, health status, and the insurer you select

When you go via the application and medical test, the life insurance policy business will certainly assess your application. Upon approval, you can pay your initial premium and authorize any pertinent documents to guarantee you're covered.

You can choose a 10, 20, or 30 year term and delight in the included tranquility of mind you deserve. Functioning with a representative can help you discover a plan that functions ideal for your demands.

This is despite whether the insured individual dies on the day the policy starts or the day before the policy ends. Simply put, the quantity of cover is 'degree'. Legal & General Life Insurance Policy is an instance of a degree term life insurance policy plan. A degree term life insurance plan can suit a variety of situations and needs.

Who offers flexible Level Term Life Insurance Protection plans?

Your life insurance plan can also create component of your estate, so can be subject to Inheritance Tax checked out a lot more about life insurance and tax. Allow's look at some functions of Life insurance policy from Legal & General: Minimum age 18 Optimum age 77 (Life Insurance), or 67 (with Essential Illness Cover).

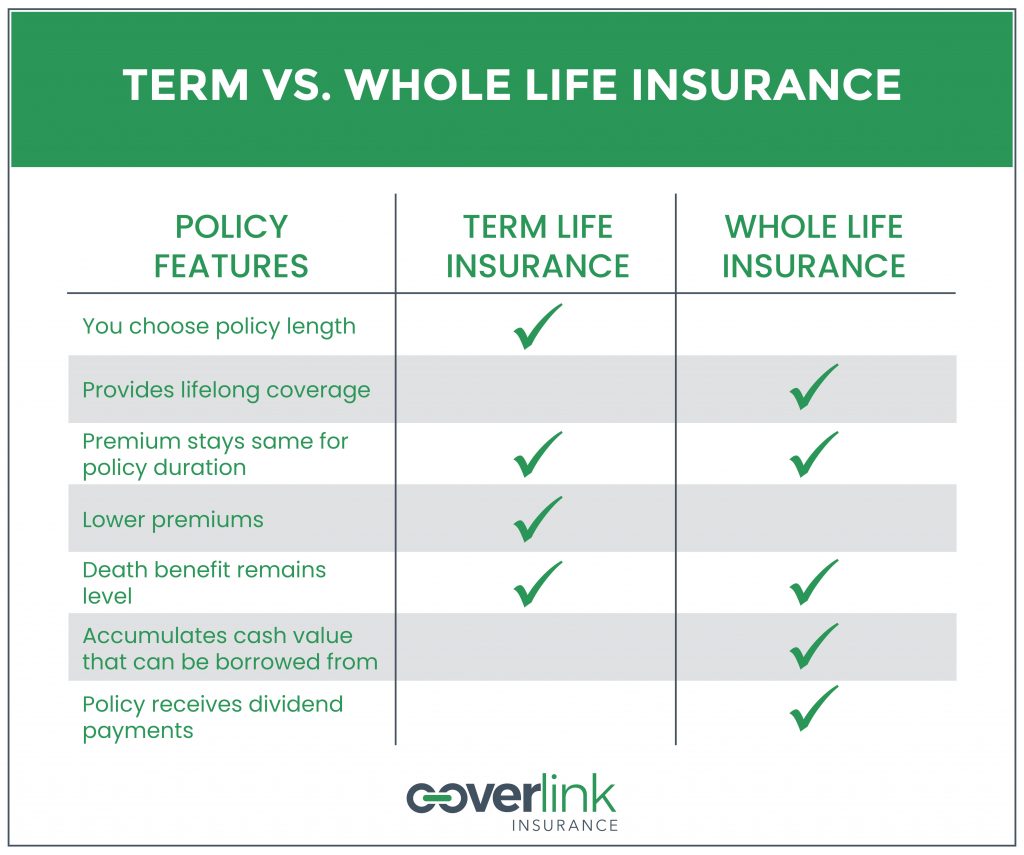

What life insurance could you think about if not level term? Decreasing Life Insurance Policy can help secure a repayment mortgage. The quantity you pay remains the very same, but the degree of cover minimizes roughly in line with the means a payment mortgage lowers. Reducing life insurance policy can aid your enjoyed ones remain in the family home and avoid any kind of additional disruption if you were to die.

Term life insurance supplies protection for a particular time period, or "term" of years. If the insured individual passes away within the "term" of the plan and the plan is still effective (active), then the survivor benefit is paid out to the beneficiary. This sort of insurance policy usually permits customers to initially buy more insurance policy protection for much less money (premium) than various other kinds of life insurance.

How do I choose the right Term Life Insurance With Fixed Premiums?

Life insurance acts as a replacement for income. The prospective danger of shedding that making power revenues you'll require to fund your family's biggest goals like purchasing a home, paying for your kids' education, decreasing financial obligation, conserving for retired life, etc.

Among the primary charms of term life insurance policy is that you can get even more protection for much less cash. Nevertheless, the insurance coverage runs out at the end of the policy's term. An additional method term policies vary from whole life or permanent insurance coverage is that they usually do not build money value gradually.

The concept behind minimizing the payout later in life is that the insured prepares for having actually decreased protection needs. You (hopefully) will owe less on your home mortgage and other financial debts at age 50 than you would at age 30. As a result, you might choose to pay a lower premium and lower the quantity your beneficiary would certainly receive, since they wouldn't have as much financial debt to pay on your part.

How long does Fixed Rate Term Life Insurance coverage last?

Our plans are created to fill up in the voids left by SGLI and VGLI strategies. AAFMAA works to understand and support your distinct financial objectives at every phase of life, customizing our service to your special circumstance. online or over the phone with among our army life insurance policy professionals at and find out more about your armed forces and today.

Level-premium insurance is a kind of irreversible or term life insurance where the costs remains the very same over the plan's life. With this sort of insurance coverage, premiums are hence assured to continue to be the very same throughout the agreement. For an irreversible insurance coverage like entire life, the amount of coverage offered boosts over time.

Term plans are additionally commonly level-premium, however the overage amount will certainly stay the very same and not grow. The most typical terms are 10, 15, 20, and three decades, based on the demands of the insurance policy holder. Level-premium insurance policy is a kind of life insurance coverage in which premiums remain the very same cost throughout the term, while the amount of protection used rises.

For a term policy, this indicates for the length of the term (e.g. 20 or 30 years); and for a permanent policy, until the insured passes away. Level-premium plans will commonly cost more up-front than annually-renewing life insurance policy policies with regards to only one year at once. Over the long run, level-premium payments are typically much more economical.

Is Compare Level Term Life Insurance worth it?

They each seek a 30-year term with $1 million in insurance coverage. Jen acquires an ensured level-premium policy at around $42 monthly, with a 30-year horizon, for a total amount of $500 annually. Beth numbers she might just require a strategy for three-to-five years or up until full settlement of her existing financial obligations.

In year 1, she pays $240 per year, 1 and about $500 by year 5. In years two with five, Jen proceeds to pay $500 monthly, and Beth has actually paid approximately simply $357 per year for the very same $1 countless protection. If Beth no longer requires life insurance policy at year five, she will certainly have conserved a great deal of money relative to what Jen paid.

Yearly as Beth grows older, she encounters ever-higher annual premiums. Jen will certainly proceed to pay $500 per year. Life insurance companies have the ability to give level-premium policies by essentially "over-charging" for the earlier years of the policy, gathering greater than what is required actuarially to cover the risk of the insured dying throughout that early period.

1 Life Insurance Policy Data, Information And Sector Trends 2024. 2 Price of insurance coverage prices are determined utilizing techniques that vary by company. These prices can differ and will typically increase with age. Prices for energetic workers may be different than those offered to terminated or retired staff members. It is necessary to consider all variables when evaluating the total competition of rates and the worth of life insurance policy coverage.

Who are the cheapest Level Term Life Insurance Calculator providers?

Like many group insurance plans, insurance coverage plans used by MetLife contain specific exemptions, exemptions, waiting durations, reductions, limitations and terms for maintaining them in force. Please contact your benefits administrator or MetLife for expenses and full details.

Latest Posts

Life Insurance Quotes Free Instant

Best Funeral Policy

Free Instant Life Insurance Quotes