All Categories

Featured

Table of Contents

Which one you pick depends on your requirements and whether the insurance company will certainly authorize it. Policies can additionally last till defined ages, which in many cases are 65. As a result of the numerous terms it supplies, level life insurance policy supplies possible insurance policy holders with versatile choices. Past this surface-level information, having a greater understanding of what these strategies involve will aid ensure you acquire a plan that meets your requirements.

Be mindful that the term you pick will affect the costs you spend for the policy. A 10-year degree term life insurance plan will set you back less than a 30-year policy due to the fact that there's much less opportunity of an occurrence while the plan is active. Lower threat for the insurance provider corresponds to reduce costs for the policyholder.

Your family's age ought to also influence your plan term choice. If you have young kids, a longer term makes feeling since it shields them for a longer time. If your youngsters are near adulthood and will be monetarily independent in the close to future, a much shorter term might be a much better fit for you than a prolonged one.

Nevertheless, when comparing entire life insurance coverage vs. term life insurance policy, it deserves noting that the latter typically costs much less than the previous. The outcome is a lot more protection with lower costs, offering the very best of both globes if you require a significant quantity of insurance coverage but can't manage an extra pricey plan.

How Does Term Life Insurance With Accidental Death Benefit Work?

A level survivor benefit for a term plan generally pays out as a round figure. When that happens, your beneficiaries will get the entire amount in a single payment, and that amount is ruled out income by the IRS. For that reason, those life insurance profits aren't taxed. However, some degree term life insurance policy business permit fixed-period repayments.

Interest settlements obtained from life insurance policy policies are considered earnings and go through taxation. When your level term life policy ends, a few different things can occur. Some coverage ends right away without option for revival. In various other scenarios, you can pay to extend the plan beyond its initial date or transform it into a permanent policy.

The drawback is that your eco-friendly degree term life insurance will feature greater premiums after its preliminary expiration. Ads by Money. We might be made up if you click this advertisement. Ad For newbies, life insurance coverage can be complicated and you'll have concerns you want responded to before dedicating to any policy.

Life insurance coverage companies have a formula for calculating threat using death and passion (Joint term life insurance). Insurance firms have countless clients taking out term life policies simultaneously and utilize the costs from its active policies to pay enduring beneficiaries of various other policies. These companies utilize mortality tables to approximate how lots of individuals within a certain team will file death insurance claims each year, which info is made use of to establish ordinary life expectations for prospective policyholders

In addition, insurance policy business can spend the money they receive from costs and increase their revenue. The insurance coverage company can invest the money and gain returns.

The following area information the pros and disadvantages of degree term life insurance. Foreseeable costs and life insurance policy coverage Streamlined plan structure Potential for conversion to irreversible life insurance policy Minimal protection duration No money worth buildup Life insurance coverage premiums can increase after the term You'll discover clear benefits when contrasting degree term life insurance policy to other insurance coverage types.

What Does Increasing Term Life Insurance Provide?

You constantly recognize what to anticipate with low-priced degree term life insurance policy coverage. From the moment you take out a plan, your premiums will certainly never ever transform, aiding you plan economically. Your insurance coverage will not vary either, making these policies effective for estate planning. If you value predictability of your payments and the payouts your beneficiaries will get, this type of insurance coverage might be a great fit for you.

If you go this path, your premiums will boost yet it's constantly great to have some versatility if you wish to keep an energetic life insurance policy plan. Sustainable degree term life insurance policy is another option worth considering. These plans allow you to keep your present plan after expiration, giving versatility in the future.

Why Consider Voluntary Term Life Insurance?

You'll choose a protection term with the ideal degree term life insurance prices, yet you'll no longer have protection once the plan ends. This downside could leave you rushing to discover a new life insurance coverage policy in your later years, or paying a costs to extend your existing one.

Several entire, universal and variable life insurance policy plans have a money value component. With one of those policies, the insurance provider deposits a portion of your regular monthly costs settlements right into a cash money worth account. This account earns rate of interest or is invested, aiding it grow and supply a more substantial payout for your recipients.

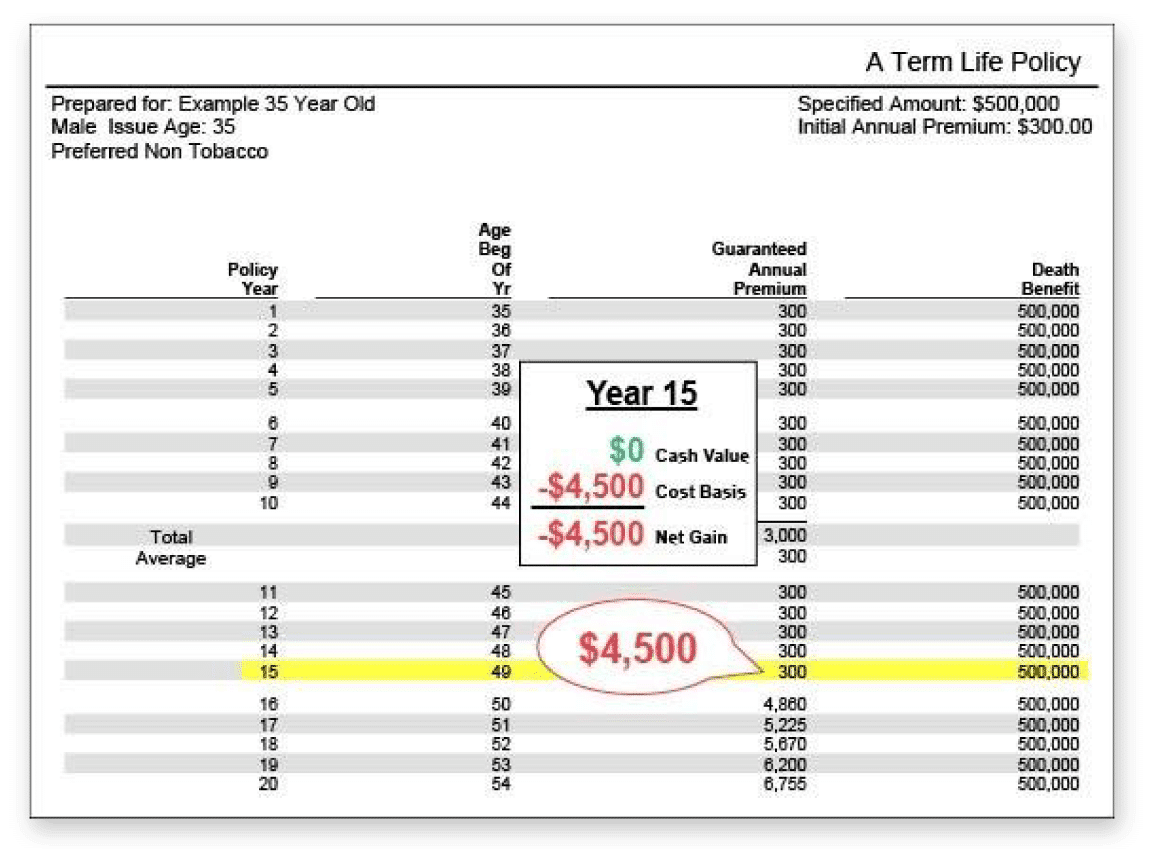

With a degree term life insurance coverage policy, this is not the case as there is no cash money value part. Consequently, your plan will not expand, and your death benefit will certainly never enhance, thus limiting the payout your beneficiaries will certainly get. If you want a plan that supplies a fatality advantage and develops cash money value, consider whole, global or variable plans.

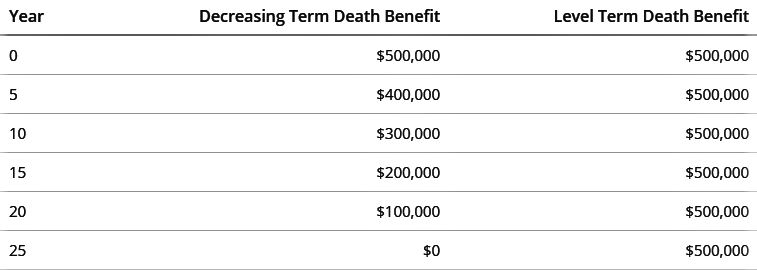

The 2nd your policy expires, you'll no more live insurance coverage. It's typically feasible to renew your plan, however you'll likely see your premiums raise substantially. This might present issues for retired people on a set revenue due to the fact that it's an added expenditure they could not have the ability to manage. Degree term and lowering life insurance policy offer comparable plans, with the major difference being the fatality advantage.

It's a kind of cover you have for a particular amount of time, called term life insurance policy. If you were to pass away while you're covered for (the term), your liked ones receive a set payout concurred when you get the policy. You just select the term and the cover amount which you might base, for example, on the cost of raising kids until they leave home and you could use the settlement in the direction of: Aiding to settle your home loan, financial obligations, bank card or fundings Helping to pay for your funeral expenses Helping to pay college charges or wedding event prices for your children Assisting to pay living prices, replacing your earnings.

The Ultimate Guide: What is Term Life Insurance With Accelerated Death Benefit?

The policy has no money worth so if your repayments stop, so does your cover. If you take out a degree term life insurance coverage plan you might: Select a repaired quantity of 250,000 over a 25-year term.

Latest Posts

Life Insurance Quotes Free Instant

Best Funeral Policy

Free Instant Life Insurance Quotes